Q2 2025 MULTIFAMILY MARKET UPDATE

- Colliers | Columbus

- Aug 20, 2025

- 2 min read

Written by: Stephanie Morris

Stephanie specializes in research capabilities, providing support for the Colliers Columbus Office, Industrial, and Retail groups. She is responsible for executing data reports, maintaining a commercial property database, reporting quarterly trends, performing data analysis, and utilizing statistical information to predict future behavior in the market. Keep reading for Stephanie's insights on the Columbus multifamily market in Q2 2025.

Key Takeaways

Columbus maintained positive rent growth despite an anticipated record year of deliveries.

Vacancy lowered despite the influx of new supply and owners continue to tout record leasing velocities.

Revenue growth remains strong with anticipated tailwinds into 2026.

Regional Summary

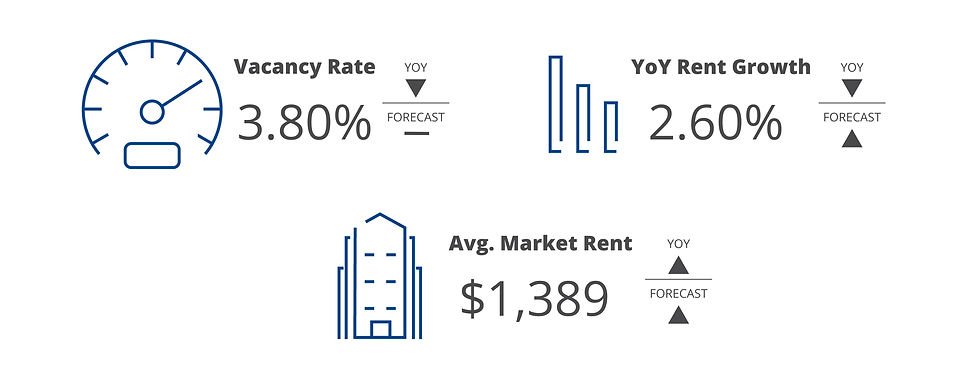

The Columbus multifamily market remained resilient in Q2 2025 despite record supply deliveries in the first half of the year. Market vacancy fell to 3.80%, with demand expected to outpace supply as 2026 deliveries are projected to drop to just 56% of 2025 levels. The market is also set to benefit from a wave of major job-creating projects, including OhioHealth’s Riverside Women’s Health expansion and The Ohio State University’s new Wexner Medical Center Hospital Tower, both of which will bolster housing demand. The MSA’s unemployment rate declined by 10 basis points quarter-over-quarter, with the largest job gains in Construction and Financial Services. Year-over-year revenue growth is expected to peak at 5% in Q3 2025 before stabilizing near 3%, while the Net Inventory Ratio is projected to fall to 1.80% by Q2 2026. Columbus continues to attract strong institutional capital interest, with elevated competition for the region’s limited available supply.

Under Construction

Multifamily construction in Columbus remained robust in Q2 2025 despite elevated construction costs and persistent interest rates. Approximately 9,100 units are expected to deliver this year, though activity has been heavily front-loaded in the first half. Nationally, demand continues to outpace supply, a trend likely to intensify given ongoing development headwinds. The Columbus MSA is projected to see a sharp pullback in 2026, with only 5,153 units expected to come online. Among properties built in 2024 or later, current occupancy averages 54.12%, with market rents at $1,722. Over the past 12 months, 5,172 units were absorbed, a 356% year-over-year increase, keeping pace with anticipated 2026 deliveries. The new construction market is expected to stabilize through 2025, with demand projected to outstrip deliveries early next year, driving rent growth and reducing the temporary concessions prevalent in the first half of 2025. Due to development pressures, our team has revised down 2026 and 2028 delivery projections by roughly 300 units and 1,300 units, respectively, with the 2028 adjustment concentrated in high-cost urban projects and large master-planned communities. However, anticipated rate cuts are expected to spur renewed construction activity, boosting 2027 deliveries.

Check out the full Q2 2025 Multifamily Trends report here!

Comments