Q3 2025 MULTIFAMILY MARKET UPDATE

- Colliers | Columbus

- Dec 9, 2025

- 3 min read

Written by: Stephanie Morris

Stephanie specializes in research capabilities, providing support for the Colliers Columbus Office, Industrial, and Retail groups. She is responsible for executing data reports, maintaining a commercial property database, reporting quarterly trends, performing data analysis, and utilizing statistical information to predict future behavior in the market. Keep reading for Stephanie's insights on the Columbus multifamily market in Q3 2025.

Key Takeaways

YoY rent growth remains positive but is decelerating due to seasonality and elevated YTD deliveries. Workforce housing continues to outperform discretionary product.

Long-term Treasury yields fell ~20 bps QoQ, creating a more competitive credit environment with tighter spreads and improved market liquidity.

Multifamily development remains active, with a notable shift in concentration toward the northern suburban submarkets of the Columbus MSA.

Fannie Mae and Freddie Mac increased their 2026 loan repurchase caps to $88B, up $15B each from 2025, with 50% of repurchases required to be mission-driven.

Regional Summary

The Columbus multifamily market continues to be viewed by capital as one of the nation’s most stable, growth-oriented environments, supported by resilient occupancy, steady revenues and a significant economic development pipeline that has yet to fully materialize. Investors remain drawn to the region’s inherent affordability, disciplined delivery schedule, ongoing infrastructure build-out and strong job creation momentum. With interest rates trending downward quarter-over-quarter and credit spreads tightening amid increasingly competitive lending markets, Columbus continues to benefit from healthy liquidity. Capital is concentrating on well-located assets with predictable supply pipelines.

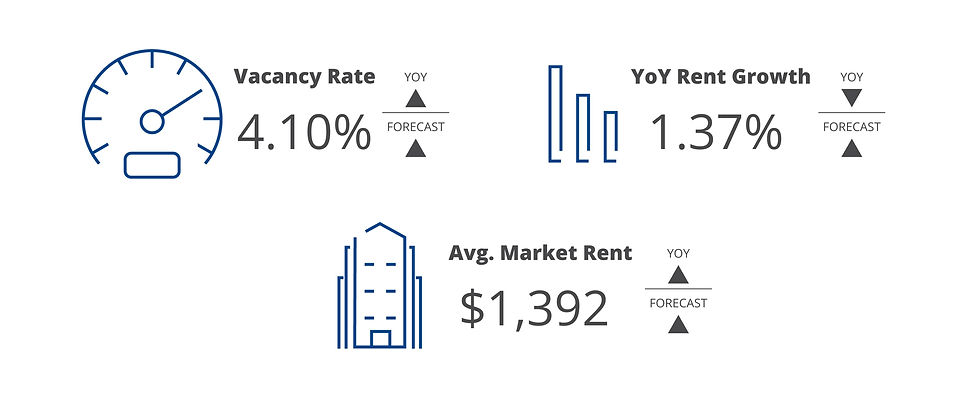

Market vacancies for existing assets inched up to 4.10% this quarter, while year-over-year rent growth moderated to 1.37% as seasonal leasing patterns set in. Workforce housing continues to outperform discretionary product, supported by tighter vacancy and stronger rent growth as renters seek more attainable options. As supply pressures ease and Columbus’ major job-creating investments begin delivering, discretionary product is expected to regain rent growth momentum heading into 2026.

Under Construction

Multifamily construction in Columbus remained notably resilient through Q3 2025 as developers continue racing to meet Central Ohio’s extraordinary, demand-driven growth. With the Federal Reserve cutting short-term rates twice this year, and an 83% probability of an additional cut in December, developers are seeing meaningful relief on interest carry that is helping expand project return thresholds. Construction costs have also moderated, supported by a ~23% pullback in timber pricing from the August 2025 peak.

Updated pipeline data reflects a modest downtick in 2025 deliveries, revised from 9,057 to 8,561 units; however, 2026 activity is accelerating. Easier capital markets, the restart of previously stalled projects, and several newly fast-tracked proposals have pushed projected 2026 deliveries from 5,153 units last quarter to an estimated 8,138 units today. The most active submarkets include Downtown + German Village, Short North + University District, Hilliard, Dublin + Powell, and North Columbus. Since Q4 2024, the Downtown/Short North core has declined from ~25.5% to ~18% of total activity, while northern suburban submarkets have experienced the largest gains in activity.

Currently, approximately 9,220 market-rate units are under construction across the Columbus MSA, representing ~4.4% of the total 50-unit+ inventory. Another 11,261 units remain in lease-up, which is expected to normalize rapidly through Q2 2026 as the front-loaded 2025 delivery wave stabilizes. Lease-up figures include properties delivered within the last two years that have not yet surpassed the 80% occupancy threshold.

Check out the full Q3 2025 Multifamily Trends report here!

Comments